Exploring The Future of AI‑Powered Insurance Underwriting

As technological advancements reshape the insurance industry, companies are looking to minimize risks and leverage new technology such as artificial intelligence (AI) to improve the underwriting process. As an insurer, you may be wondering if AI is something that could help address challenges within your business.

Nontraditional Underwriting Using AI

Depending on the type of insurance, the underwriting process typically involves gathering information about an applicant's financial situation, health history, or driving record, among other things. Once this information is collected, it is used to calculate a premium that is fair to both the insurer and the applicant.

However, traditional underwriting methods are not always effective. A novel and creative method of determining creditworthiness is nontraditional underwriting using AI. Instead of the traditional process, this approach uses machine learning to analyze massive volumes of data to find trends that conventional underwriting approaches might overlook.

AI may be applied in a variety of nontraditional underwriting scenarios, such as:

- Gathering data: Data from several sources, including social media, public records, and credit reports, can be gathered using AI. This information can provide insurers a fuller view of a candidate’s risk profile.

- Faster and more effective data analysis: Compared to humans, AI can analyze data faster and more effectively. As a result, it makes quicker underwriting decisions.

- Determine trends and patterns: Data can exhibit patterns and trends that humans might overlook.

Benefits of Using AI for Underwriting

Compared to conventional procedures, nontraditional (AI-powered) underwriting offers several benefits over traditional methods, which can harbor prejudice toward minorities and those with disabilities in addition to being costly and time consuming.

First, premiums are more accurate. By providing a thorough picture of an applicant's risk profile, AI can assist insurers in more accurately calculating rates. This could result in premiums that are more equitable for the applicant and the insurer.

It’s also faster. With AI, insurers can automate many underwriting activities traditionally performed by humans such as data gathering and data analysis. As a result, applicants may have to wait less time, and insurers can close more business. An additional benefit is that nontraditional underwriting enables lenders to evaluate a borrower's creditworthiness based on more than simply their credit history. This can contain information like work history, educational background, and even social media use.

Finally, AI-powered underwriting helps minimize prejudices embedded in the traditional underwriting process, ensuring that everyone has equitable access to insurance.

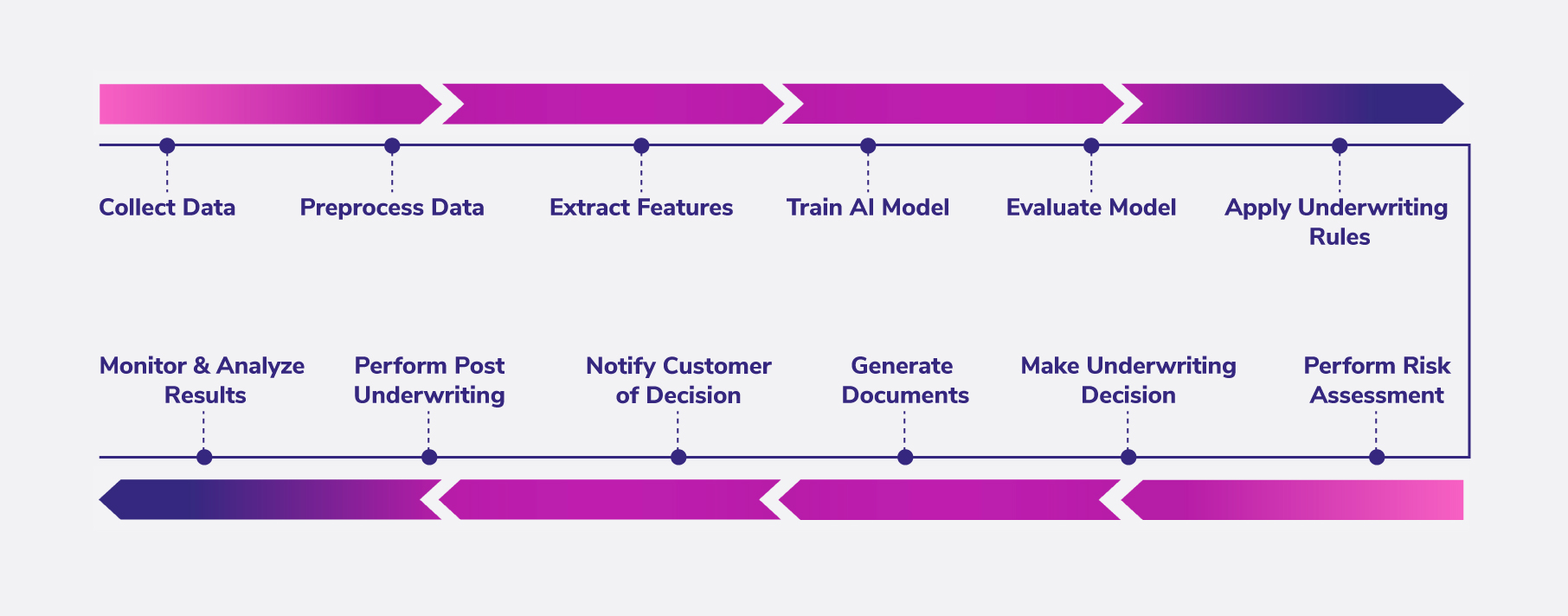

Here is the framework illustrating the process of nontraditional underwriting system using AI:

Challenges of Using AI for Underwriting

While nontraditional underwriting has many potential benefits, there are also risks and challenges associated with this approach. First, AI raises data privacy concerns as it involves collecting and analyzing vast amounts of personal information potentially leading to unauthorized access or misuse.

Just as insurers must take care to protect the data they collect, they must also be aware of—and work to correct—algorithmic biases. Research shows that AI systems may be prejudiced against particular social groupings. Insurers must reduce this risk by carefully developing their algorithms and keeping an eye on how they function. And of course, cost can be a factor. Insurance companies must compare the costs of employing AI with the potential advantages.

Ethical Considerations of Using AI in Underwriting

In addition to the aforementioned difficulties, a number of ethical issues must be taken into account when employing AI for underwriting. For instance, insurers must exercise caution when using AI to discriminate against particular categories of individuals. Additionally, they must be open about their use of AI and provide applicants with the chance to appeal their underwriting choices.

The Current Regulatory Landscape

Regulators are paying attention as nontraditional underwriting grows more prevalent. The U.S. Consumer Financial Protection Bureau (CFPB) published guidelines on the application of alternative data in credit underwriting. These guidelines place a strong emphasis on the necessity of openness and justice in the underwriting process.

Other nations are also investigating how nontraditional underwriting may affect regulations. For instance, the General Data Protection Regulation (GDPR) of the European Union imposes stringent guidelines on the gathering and use of personal data, which may have an influence on the application of AI in underwriting.

Generative AI as a Creative Collaborator

In a July 2023 post, Bounteous SVP of Experience Design Michael Mayton emphasized the need to adapt to and harness the power of generative AI rather than resist its inevitable progression. As a steadfast digital transformation partner, Bounteous provides comprehensive training, documentation, and continuous support to empower internal teams with underwriting systems and AI models. Our commitment to compliance and security ensures alignment with pertinent laws and industry standards, bolstering data protection through robust security measures and mitigating risks of breaches or unauthorized access.

Using nontraditional underwriting methods holds the potential to revolutionize the relationship between borrowers and lenders. However, finding the delicate balance between innovation and accountability comes with challenges. Having accumulated decades of experience in assisting clients with their digital investment strategies, we recognize that innovation is an ongoing journey rather than a one-time project.