Fintech: Redefining the Banking Experience

Accelerated digital disruption is pushing traditional financial institutions towards an inflection point. Fintechs including Klarna, SoFi, Affirm, Stripe, Robinhood, and Credit Karma have been around for close to, and in some cases, even longer than, a decade; they were at the forefront in leveraging technologies to deliver new customer experiences.

In the last few years, long-established institutions have begun to realize that fintechs are here to stay and that they will need a strategic plan to compete. Some have begun to take action—creating partnerships, making acquisitions, and developing and launching their own versions of what fintechs are doing—like offering credit card customers the option to pay for their purchases in installments to compete with buy now, pay later.

Brick-and-mortar locations have historically been the center of the customer banking experience, but customers have been tech-immersed for years. They shop for groceries, order take-out, send and receive payments, consolidate student loans, apply for credit cards, and shop for mortgages all online, often across multiple devices. Customer expectations of their relationships with financial institutions have changed.

Traditional players wrestle with how to respond to mature and emerging fintechs as they shape and alter the way consumers and businesses operate. From open banking to decentralized finance, cryptocurrency to meme-stock investing, the ways that consumers save, spend, borrow, and invest their money is changing. And, this is all happening digitally.

Creating a strategic plan for digital transformation is crucial for financial institutions to remain relevant, and to compete with fintechs, new and mature. In order to continue to acquire customers, deepen customer relationships, and retain their business, banks must change traditional industry norms, making sure their digital experience reflects the first-class customer experience they've cultivated for decades.

Launching a New Business Model

Core to any strategic plan for digital transformation is the need to leverage technology as an enabler in delivering enhanced customer experiences. By implementing advanced data and analytics technologies, for example, institutions can capture data and insights to continuously identify opportunities to innovate, and in turn to drive revenue and growth.

When developing new digital products and services, companies should ensure all stakeholder groups who will play a role in delivering the customer experience—from acquisition to servicing—collaborate on the design and build. By orienting product and service offering development around the delivery of quality customer experiences, companies can ensure a streamlined, end-to-end process.

Get Smart on Cross-Selling

To generate maximum value, companies need to become experts on delivering meaningful, consumer-centric content and experiences. By re-centering banking around a holistic view of a customer and developing and applying data and analytics strategies, financial institutions can reduce internal cross-sell competition, reduce marketing expenses, and maximize profitability—all while delivering a relevant and timely customer experience.

The rise of solutions focused on first-party data activation, like Customer Data Platforms (CDPs), helps firms generate a single-view-of-the customer and make sense of the trove of customer data housed in data lakes and data warehouses. CDPs enable the creation of unified profiles so companies know who their customers are at an individual level. Data scientists use a variety of tools to derive insights from this customer data which is in turn used to develop and activate outreach strategies: when, where, and how to best engage with individual customers.

Personalized Offers and Experiences

Consumers expect to transact quickly and seamlessly, from wherever they are, but, despite big investments to improve mobile apps and customer service experiences, many financial institutions come up short on building lasting relationships with customers. Building a one-size-fits-all experience, no matter how "innovative" it may seem, is simply not enough; it is critical to leverage data and insights to create a highly personalized—and ideally hyper-personalized, experience. It is through hyper-personalized marketing that an institution is able to demonstrate that it "knows" the customer, and is, in turn, able to earn the customer’s trust. Financial institutions who earn the customer’s trust benefit from long-term relationships.

Swedish fintech firm, Klarna, is a great example of an industry disruptor who invests in data and analytics to ensure it continuously innovates brand experiences centered around the customer. Klarna continues to intelligently personalize experiences, especially on their one-stop-shop app, sharing, “Consumers can also create shareable Wish Lists, get price drop notifications and access exclusive deals from the brands they love through the app, all with the option to pay over time with zero interest or fees.”

As fintechs, like Klarna, continue to get more granular and more creative, financial institutions cannot continue to rely on the current way of interacting with customers.

The Change Management Hurdle

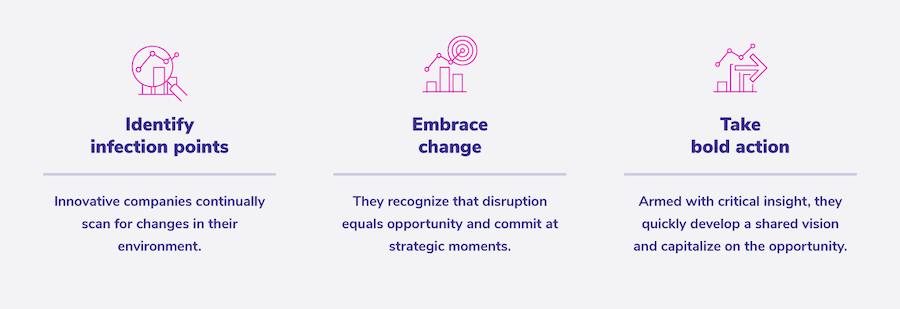

As innovations accelerate, so does the war for top talent. How can change management fulfill its mandate to deliver customer-centric products and services in a climate of shortening stakeholder and leadership tenure? The solution has three parts.

First, education around innovation cycles and what it takes to reach a stated goal is critical. Co-Innovation partners can provide additional expert resources for improving process and employing methods along with technology partners. It may be beyond one individual’s tenure, but a clear strategic plan can be followed by a broader group.

Second, adoption and launch do not signal the end of an innovation cycle. In fact, it's just the beginning. Managing and optimizing new digital products and platforms is where digital innovation value is multiplied through testing, learning, and repeated iteration. An obsession with properly connecting, collecting, and interpreting data can help prove the effectiveness of marketing efforts and connect disparate platforms to provide more personalized and relevant experiences.

Finally, accountability must be shared by a broad stakeholder group, responsibility must rest with the highest levels, and the right partners must be entrusted. Re-centering product and service innovation around the customer requires many teams and business units to efficiently work towards a single goal and additional further insights awaiting those that cross the finish line.

Bring on The Experts

In order to compete and win, financial institutions are predicted to increase their investments in technology and marketing in the coming years, but how will they maximize value? The answer to this question will determine the next category leaders and laggards. Only with the right strategy, talent, and technology will firms surpass their competition and create lasting innovation.